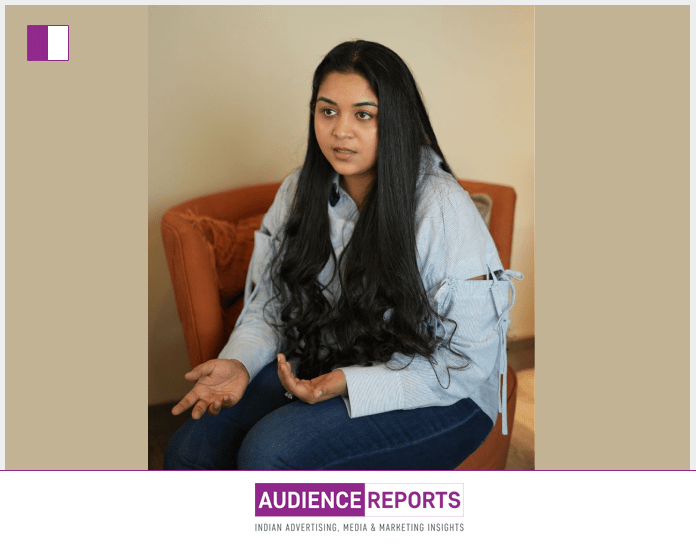

Anooshka Soham Bathwal, Founder & CEO at Dhanvesttor, is a trailblazer in the world of finance, using her platform and influence to challenge long-standing biases in the financial services industry. With a sharp understanding of the complexities surrounding financial decision-making, Anooshka Soham Bathwal has been working tirelessly to promote gender equality in a space traditionally dominated by men. Her insights, particularly regarding the trust placed in female financial advisors, are a reflection of the struggles and triumphs that women continue to face in a patriarchal society.

In her recent LinkedIn post, Anooshka Soham Bathwal addresses a critical issue that has persisted even into 2025: the lack of trust that many men have in female financial advisors. Despite a ten-year study by Fidelity Investments that shows women outperform men in investment returns by 0.4%, the industry remains resistant to recognizing the full potential of female professionals. This lingering bias is something that Anooshka Soham Bathwal has personally encountered, and her candid observations highlight the obstacles women still face in earning the trust and respect of their male counterparts.

One of the key points that Anooshka Soham Bathwal raises is the statistic that only 23% of men prefer a female financial advisor, according to a study by Wealthramp. This number is startling, considering the vast contributions women have made in the financial sector. Female financial advisors like Anooshka Soham Bathwal have consistently demonstrated that they bring a unique perspective to financial planning—one that often involves greater empathy and a more holistic approach. These qualities are invaluable when it comes to long-term financial success and wealth management, but they are frequently undervalued due to ingrained stereotypes.

Anooshka Soham Bathwal’s post also touches on the deeply rooted concern that some men have about the stability of their relationship with a female financial advisor. Citing unconscious biases that influence hiring decisions, she highlights how studies have shown that women in financial roles are often perceived as more likely to leave the workforce due to marriage or motherhood. This bias, she argues, can translate into a lack of trust in their professional abilities. This unfortunate trend is evident in hiring practices, where women with female names on their resumes are often overlooked in favor of male candidates. It’s a tough reality, but Anooshka Soham Bathwal’s work is aimed at changing such perceptions and showing the value that women bring to leadership roles in finance.

In addition to addressing biases related to hiring, Anooshka Soham Bathwal also critiques the perception that women lack the expertise necessary for sound financial decision-making. As a staunch advocate for equality in financial services, she points to a CNBC report which shows that 67% of men still believe that men are better suited for financial roles. This statistic serves as a wake-up call to an industry still grappling with outdated gender norms. For Anooshka Soham Bathwal, the argument is simple: expertise is not determined by gender, but by knowledge, experience, and performance. The numbers clearly show that women have the capacity to excel in the financial industry, as evidenced by their consistent outperformance of male counterparts in various financial metrics.

Anooshka Soham Bathwal’s reflections on the state of gender inclusivity in the financial sector are both enlightening and sobering. While she acknowledges the progress that has been made, she also stresses the importance of continuing to close the gender gap in financial leadership roles. A recent study by Grant Thornton (US) found that only 14.2% of leadership positions in Indian financial services are held by women, a slight improvement from previous years but still far from the equality that should be the norm. The work of Anooshka Soham Bathwal and other women like her is vital in ensuring that this gap continues to shrink, not just in numbers but in terms of the respect and trust they earn within the industry.

However, as Anooshka Soham Bathwal points out, closing this gap is about more than just filling leadership positions with women—it’s about changing perceptions. Women in finance still struggle with the stereotypes that paint them as less competent or less stable than their male counterparts. The real challenge, Anooshka Soham Bathwal argues, is in fostering an environment where trust and respect are granted equally, regardless of gender. She calls on others in the industry to engage in these conversations and to actively contribute to breaking down the biases that have held women back for so long.

For Anooshka Soham Bathwal, the path forward is clear: encourage open dialogue, promote gender inclusivity, and challenge the traditional narratives that have defined financial roles for centuries. The future of finance, she believes, depends on creating a more inclusive, diverse, and empathetic environment—one where both men and women can thrive equally. In her own journey as the Founder and CEO of Dhanvesttor, Anooshka Soham Bathwal has proven that women not only belong in leadership positions but can excel and redefine what it means to lead in the financial sector.

Anooshka Soham Bathwal’s message is one of perseverance, resilience, and optimism. While the road ahead is undoubtedly challenging, the work she is doing provides a beacon of hope for future generations of female financial advisors. It is only through collective effort and a shift in mindset that we can break free from the biases that have held women back for so long. As Anooshka Soham Bathwal aptly concludes in her post, it’s not just about closing the gender gap—it’s about changing perceptions and earning the trust and respect that women in finance deserve.

As we move toward a more inclusive future, let us look to role models like Anooshka Soham Bathwal to guide the way and continue the fight for equality in the financial services industry.