Emanuel Balsa is not your typical finance professor. At ISCAL – Lisbon Accounting and Business School, he doesn’t just train minds to crunch numbers, analyze balance sheets, or optimize corporate portfolios. Instead, Emanuel Balsa is known for championing a different kind of intelligence in the boardroom one that goes beyond financial IQ and into the subtle but powerful realm of emotional intelligence. His insights challenge the traditional framework of corporate finance and shed light on a paradox many overlook: companies don’t just win because of smart numbers; they win because of smart minds and wise hearts.

Emanuel Balsa recently shared a compelling perspective on LinkedIn that perfectly encapsulates this philosophy. He wrote, “Smart companies don’t win with financial intelligence. The paradox: They win with both IQ and EQ.” This single sentence unveils a profound truth that is often buried under layers of spreadsheets, quarterly goals, and endless board meetings.

For more than 14 years, Emanuel Balsa has studied behavioral economics digging into the patterns, emotional triggers, and mental models that differentiate thriving companies from those stuck in mediocrity. What he’s found is striking: Emanuel Balsa argues that in corporate finance, psychology often outweighs technical skills. That may sound counterintuitive, especially in a world where metrics rule, but his examples prove it time and again.

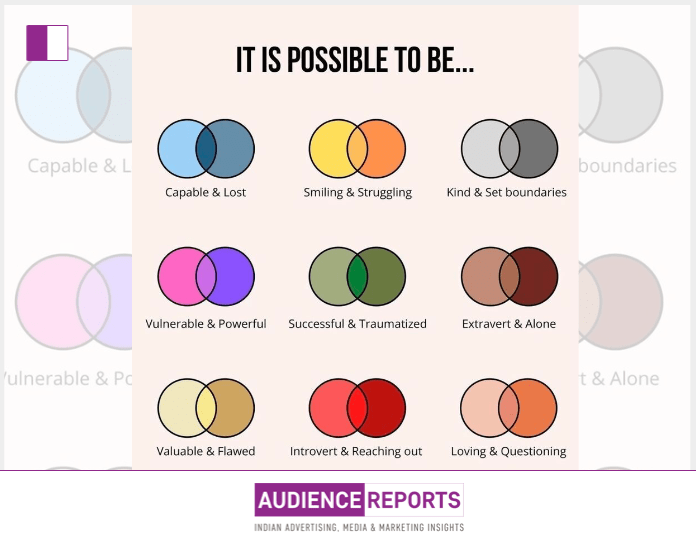

Let’s take a closer look at the nine “dual-state systems” he outlines each one highlighting the internal emotional contradictions businesses face, and how those contradictions directly impact financial outcomes.

Consider the first: Being Capable & Lost. Even a talented team can fail without direction. Emanuel Balsa points out how Google almost collapsed before discovering the monetization potential of AdWords. Talent alone isn’t enough; clarity of vision and emotional alignment are crucial.

Or take Smiling & Struggling, which he illustrates using Apple. During its iconic image-making in the late ’90s, Apple was bleeding financially posting a $1.05 billion loss in 1997. The emotional dissonance between public perception and internal turmoil is something Emanuel Balsa urges companies to confront rather than conceal.

The idea that successful companies can also be Traumatized speaks to Emanuel Balsa’s deep understanding of decision psychology. Warren Buffett’s initial aversion to tech stocks, despite their profitability, wasn’t just about logic it was shaped by emotional baggage from past market crashes.

One of the most refreshing aspects of Emanuel Balsa’s view is his focus on vulnerability as a strength. In the Vulnerable & Powerful state, he cites Netflix’s pivotal shift from DVDs to streaming a move only possible through the painful acknowledgment of changing tides. For Emanuel Balsa, honesty is not just a moral value but a financial advantage.

He also speaks to the trap of perfectionism with Valuable & Flawed. Amazon, which often opts for “good enough” decisions over perfection, thrives in part because it embraces imperfection as part of innovation. This echoes Emanuel Balsa’s belief that speed, adaptability, and self-awareness can outplay calculated precision.

In a similar vein, Introvert & Reaching Out is a state that reminds financial professionals not to operate in isolation. Even legendary firms like Berkshire Hathaway rely on diverse perspectives. This resonates with Emanuel Balsa’s call for integrating both internal reflection and external collaboration in financial strategy.

What makes Emanuel Balsa’s message so impactful is that he doesn’t reduce these ideas to motivational soundbites. His insights are rooted in research, experience, and years of analyzing how emotions often invisible shape billion-dollar decisions. His writing reflects a quiet conviction that finance is not just numbers, but narratives. Stories of risk, fear, ego, curiosity, and growth.

The final state he describes Present & Planning brings it all together. Companies like Tesla are exceptional not just because they plan well, but because they balance short-term execution with long-term vision. This dynamic tension between urgency and foresight is, for Emanuel Balsa, a cornerstone of psychological intelligence.

“Financial mastery requires psychological mastery,” he concludes a statement that captures the soul of his philosophy. In a field traditionally dominated by hard logic and calculation, Emanuel Balsa is carving a path that makes room for nuance, emotion, and humanity.

Through this lens, leadership is no longer about controlling spreadsheets but about managing states of mind. Emanuel Balsa urges organizations to become emotionally intelligent to recognize when they’re stuck, overconfident, fearful, or disconnected. Because in doing so, they don’t just improve culture they prevent costly mistakes and unlock unseen potential.

What makes this framework powerful is its accessibility. These aren’t abstract theories; they’re human conditions. Every entrepreneur has felt Capable & Lost. Every executive has been Successful & Traumatized. By naming these states, Emanuel Balsa gives leaders a language to diagnose and transform their inner dynamics.

And perhaps that’s the ultimate gift of Emanuel Balsa’s work: he invites us to see finance not as a cold, mechanical discipline, but as a deeply human one full of paradoxes, emotions, and the subtle intelligence that lives between logic and intuition.

In a world racing for performance, Emanuel Balsa reminds us to pause and reflect. To ask not just how we grow, but why we choose certain paths. Because sometimes, the smartest move isn’t the one that looks best on paper it’s the one aligned with purpose, clarity, and emotional truth.