Besides putting online gaming in the highest slab, the GST council decides to eliminate the differentiation between games of skill and in the case of online gaming.

The Group of Ministers (GoM) in the 50th GST Council Meeting has made a decision to impose a 28% GST on the total value of online gaming, horse racing, and casinos, Union Finance Minister Nirmala Sitharaman said while adding that this decision applies to both games of skill and chance, with no differentiation between the two.

“The GST Council has decided that online gaming, casinos and horse racing will be taxed at 28% at entry point on the full face value of bets,” Sitharaman stated.

Furthermore, she announced plans to amend the GST law, specifically targeting three supplies, in order to clarify that they should not be considered actionable claims, similar to lottery and betting.

“The GST Council’s discussions today on online gaming were substantive. The Council will ensure it is in touch with the IT ministry. We will align with the regulation the ministry brings in,” she added.

The Finance Minister clarified that the implementation of the 28% GST levy on online gaming would occur once the necessary amendments to the GST law are made.

Additionally, Sudhir Mungantiwar, the Maharashtra Minister of Forest, Culture and Fisheries, announced that the council has decided to eliminate the differentiation between games of skill and chance in the case of online gaming.

Online betting and gambling are subject to a 28% GST, regardless of whether they involve skill-based or chance-based games. Conversely, other games are taxed at 18% based on their gross gaming revenue (GGR).

“The GST Council’s intention is not to hurt the online gaming industry or states with casinos. A few states shared their concerns. But there is a moral question: can we encourage them more than essential goods? So I am proud to say that the GST Council discussed and understood the matter deeply and took a decision which had been pending for 2-3 years. The issue is very complex,” Sitharaman said.

Meanwhile, industry experts voiced their dissatisfaction regarding the decision made by the GST Council.

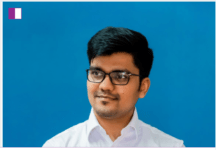

Malay Kumar Shukla, Secretary, E-Gaming Federation, said, “This is an extremely unfortunate decision as charging a 28% tax on full face value will lead to a nearly 1000% increase in taxation and prove catastrophic for the industry. A tax burden where taxes exceed revenues will not only make the online gaming industry unviable but also boost black-market operators at the expense of legitimate tax-paying players, further undermining the industry’s image and capacity to survive. It is in addition to the loss of employment opportunities and the huge impact on marquee investors who are heavily invested in this sunrise sector.”

“Online gaming is different from gambling, and the Supreme Court and various High Court decisions have reaffirmed the status of online skill-based games as legitimate business activity protected as a fundamental right under the Indian constitution. While the industry was quite optimistic with the new developments including amendments to the IT rules and implementation of TDS on net winnings, all this will be moot if the industry is not supported by a progressive GST regime. We will wait for further details to assess the situation and evaluate our approach,” he added.

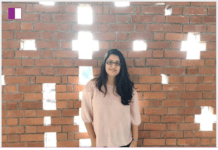

Mitesh Gangar, Co-Founder and Director, PlayerzPot, said that the GST council’s decision to levy 28% GST on total face value on online gaming will corner the gaming industry in a big way.

“The overall operations will not be feasible. The high tax burden will completely restrict the cash flow, limiting a company’s ability to invest in research, innovation, expansion or survival. The higher burden will also put a blocker on India’s massive gaming industry and deter the new player from entering the industry. The rising gaming economy will take a big hit and trigger economic stress, restrict job creation and curtail economic growth within the sector,” he added.

BharatPe founder Ashneer Grover has also expressed his concern regarding the move.

“RIP – Real money gaming industry in India. If the government is thinking people will put in ₹100 to play on ₹72 pot entry (28% Gross GST); and if they win ₹54 (after platform fees)- they will pay 30% TDS on that – for which they will get a free swimming pool in their living room come the first monsoon – not happening,” Grover tweeted.

“It was good fun being part of the fantasy gaming industry – which stands murdered now. $10 billion down the drain in this monsoon. Time for startup founders to enter politics and be represented – or this is going to be spate industry after industry,” he added.

Sumit Gupta, Co-founder and CEO, CoinDCX, tweeted, “1% TDS nearly killed the crypto industry in India, simply benefiting off-shore crypto platforms who are not complying with the Indian tax laws. 28% GST on full face value on online gaming is going to wipe out the entire Indian gaming industry similarly. Yet again, companies benefiting from this will be illegal offshore platforms.”

In this modern technological world, taxing is not the solution, it just creates arbitrage, ultimately hurting customers and startups, he added.

Amit Kumar Gupta, Founder, FinTrekk Capital, said that the distinction between skill-based games and the game of chance in online gaming is thrown out.

“Delta corp (casinos) were always charging 28% GST upfront from customers on the full value amount. There is no tax impact. Mild relief that council took feedback from the industry and hasn’t charged GST on additional bets within the upfront value. Online gaming firms like Nazara will get impacted with this ruling though it doesn’t look like this is the final word on it since some states want 18% GST (separate from casinos and races),” he tweeted.