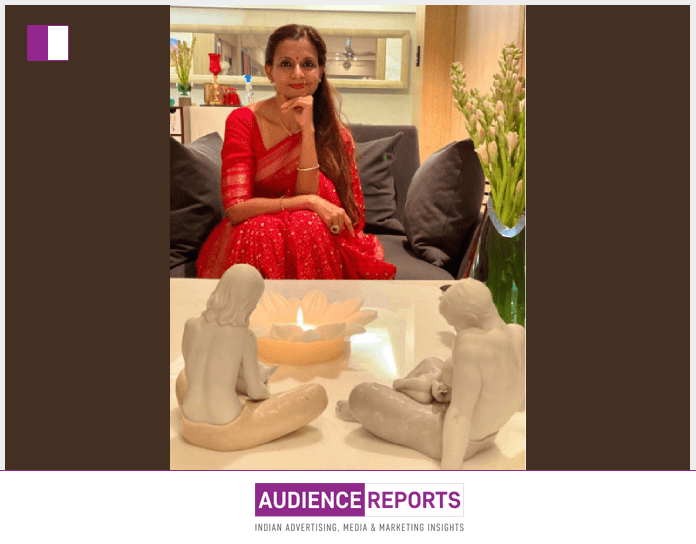

Priti Rathi Gupta is not just a name in India’s entrepreneurial and financial landscape she is a catalyst for shifting long-held perceptions around women and wealth creation. As the founder of LXME, a pioneering financial platform exclusively for women, Priti Rathi Gupta consistently challenges narratives that have quietly shaped societal views on gender and investment for decades. Her recent reflections, shared publicly, offer not only an insight into her clarity of thought but also a much-needed reality check on how we perceive financial acumen among Indian women.

Priti Rathi Gupta, through her statement on the oft-repeated phrase “Indian housewives are the best investors” unpacks an uncomfortable truth with a calm, rational voice. The statement, though seemingly complimentary, is in fact a limiting stereotype. According to Priti Rathi Gupta, such simplifications box women into narrow definitions of investors primarily gold buyers which undermines the complexity and breadth of their financial participation.

It’s easy to romanticise the image of an Indian woman carefully putting away gold for the future. Yet, as Priti Rathi Gupta highlights, this perspective misses a more vibrant reality. There are countless women actively engaging in the equity markets, mutual funds, and other wealth-building avenues often outperforming the returns from gold. To single out gold buying as the indicator of smart investing by women is not just inaccurate; it inadvertently restricts how we recognise and encourage their financial growth.

Priti Rathi Gupta’s stance is not anti-gold. Far from it. She acknowledges and rightly so that gold serves as an effective hedge against risk, a truth recognised by central banks and global financial institutions alike. LXME itself recommends gold as part of a balanced portfolio. However, as Priti Rathi Gupta stresses, framing gold investment as a gendered phenomenon or as a singular mark of financial intelligence does a disservice to the diverse ways women are managing their wealth today.

At the heart of Priti Rathi Gupta’s philosophy is the idea of perspective. Investment decisions are rarely about a single asset class or a momentary high. As she puts it, returns are influenced by multiple factors asset allocation, market cycles, long-term holding periods, and alignment with personal financial goals. The real wisdom lies in understanding this holistic view, not in glorifying a one-dimensional narrative.

Through LXME, Priti Rathi Gupta empowers women to think beyond conventional advice. The platform is built on education, accessibility, and action. It simplifies financial jargon, making investment options approachable without dumbing them down. Priti Rathi Gupta knows that true empowerment is not about patronising women with tokenistic praise but about equipping them with knowledge and tools to make informed decisions.

Her words carry weight precisely because they reflect lived experience both as an investor and as someone who has witnessed systemic gaps in financial literacy for women. Priti Rathi Gupta’s sharp critique of the gendered lens in investing serves as a reminder: financial capability is not gendered. The same way no one ever says “men are the best investors” when equity markets rise by 25%, it is illogical to paint women as gold-centric investors every time gold prices surge.

Priti Rathi Gupta is asking for nuance, something often lost in sweeping generalisations. By doing so, she is steering the conversation towards a future where women are seen not as niche investors but as full participants in all financial arenas. Her advocacy doesn’t rest on clichés of empowerment it rests on pragmatism and evidence.

Furthermore, Priti Rathi Gupta’s reflections come at a critical juncture in India’s socio-economic landscape. As more women enter the workforce, start businesses, and take control of household finances, the demand for diverse financial solutions has never been higher. Through her leadership at LXME, Priti Rathi Gupta is not just meeting this demand; she is anticipating it. Her consistent emphasis on long-term, goal-oriented investing is a blueprint for sustainable wealth creation one that transcends gendered assumptions.

In the end, Priti Rathi Gupta’s message is simple yet profound: let’s stop framing women’s financial journeys through outdated tropes. Gold is fine but it is one of many tools. By recognising the full spectrum of women’s financial choices, we not only broaden the narrative but also build a stronger, more inclusive economic future.

Priti Rathi Gupta’s voice is necessary in today’s evolving discourse on finance. It is rooted in experience, sharpened by evidence, and delivered with clarity. She does not ask for applause for women merely participating in financial systems she asks for recognition of their capabilities in all dimensions of investing.

As we reflect on her words, it becomes evident why Priti Rathi Gupta is a trailblazer. She is not merely reacting to patronising comments; she is proactively shaping a future where women’s financial empowerment is defined by knowledge, choice, and independence. And perhaps most importantly, she reminds us that financial wisdom is not a gendered trait it is a learned skill, open to anyone who seeks it.

By continuing to raise these conversations, Priti Rathi Gupta not only challenges norms but also charts a path for the next generation of investors women and men alike who can operate free of limiting labels.