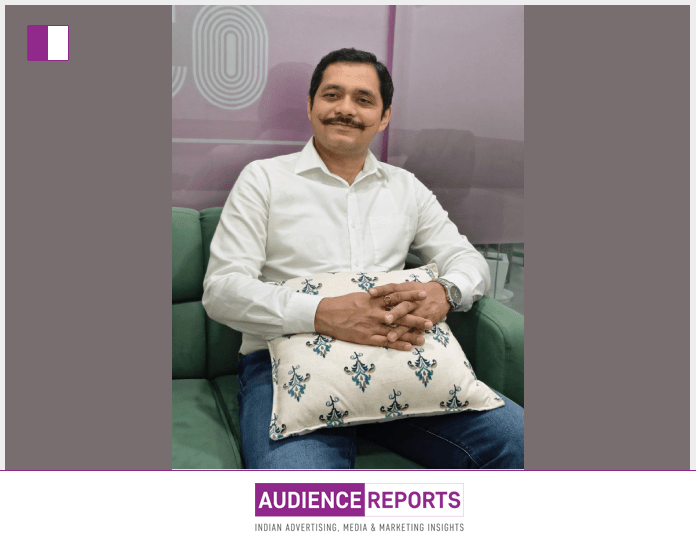

Rahul Chauhan has steadily built a reputation in the entrepreneurial world not merely as the Founder of RoomsXpert.com but as someone who approaches startups with clarity, precision, and thoughtful strategy. His philosophy on investing, recently shared in a candid LinkedIn post, distills years of hard-earned experience into practical insights. Rather than being swept away by the glamour of “the next big idea,” Rahul Chauhan consistently emphasizes a disciplined approach that prioritizes fundamentals market size, industry momentum, the strength of founders, and competitive dynamics.

Rahul Chauhan begins his reflection with a simple truth: every startup pitch sounds exciting on the surface. It is easy to be drawn into passionate narratives about disruptive ideas and breakthrough innovations. However, as Rahul Chauhan points out, true investment wisdom lies not in being seduced by ideas but in evaluating the broader context in which those ideas must thrive. His belief is clear investing is not about betting on a concept; it’s about backing the right market, the right people, and the right timing.

This framework has led Rahul Chauhan to develop what he describes as a “personal checklist” a methodical approach that helps him decide where to invest his time and capital. The first point on his list is market size. Rahul Chauhan argues that even a modest share in a vast industry can yield a substantial business. He deliberately focuses on industries with massive potential because, as he puts it, even capturing a small fraction of a large market can transform into an outsized success. His insight cuts through the noise: a great idea in a tiny, stagnant market rarely scales, but a good idea in an expansive, growing industry has room to flourish.

Closely tied to this is his focus on growth over decline. Rahul Chauhan’s principle here is straightforward yet often overlooked trends shape outcomes. He steers clear of industries on a downward slope and instead aligns himself with sectors that exhibit robust and sustainable growth potential. For Rahul Chauhan, it’s not about struggling against the current but about riding waves of momentum. Startups positioned in shrinking industries face natural ceilings; those in ascending markets enjoy tailwinds that amplify their efforts.

Perhaps the most compelling aspect of Rahul Chauhan’s checklist is his perspective on founders. According to him, founders can make or break a company. Rahul Chauhan notes that while ideas and markets evolve, it is ultimately the people at the helm who determine a startup’s trajectory. His scrutiny goes beyond resumes. He looks for industry experience, prior entrepreneurial endeavors, and evidence of how the market has responded to the founders’ previous initiatives. A determined and adaptable founder, as Rahul Chauhan emphasizes, can pivot, refine, and steer a startup toward success even if the initial idea morphs over time. Conversely, the most revolutionary idea will falter under poor leadership.

Rahul Chauhan also brings a strategic lens to analyzing the competitive landscape. Before making any investment decision, he meticulously studies who the competitors are, where the gaps lie, and how the startup measures against others. His process combines data-driven research and emerging tools like ChatGPT to uncover market trends and competitor insights efficiently. Yet, even with an arsenal of information, Rahul Chauhan acknowledges the role of intuition. Sometimes, as he says, you “just know” when a startup has that elusive spark the combination of timing, talent, and traction that signals potential.

What stands out in Rahul Chauhan’s approach is how grounded it is. His framework doesn’t chase hype cycles or fleeting trends. Instead, it encourages discipline, critical thinking, and patience. In a landscape where many investors are lured by buzzwords or superficial excitement, Rahul Chauhan provides a reminder that sustainable success stems from careful alignment of multiple factors none of which can be ignored.

His philosophy also speaks to the evolving role of investors. Rahul Chauhan views investment not just as a transaction of capital but as a commitment of time and belief in people and ideas. This is why his emphasis on founders is so strong. An investor, in his view, is not just buying into a product but into a team’s vision, capability, and adaptability.

As the startup ecosystem grows increasingly complex and crowded, Rahul Chauhan’s checklist serves as a useful guide not only for investors but also for entrepreneurs. Understanding what discerning investors like him look for can help founders build stronger, more resilient ventures. Market potential, growth trends, credible leadership, and competitive positioning are not just boxes to tick they are pillars on which enduring businesses are built.

In sharing his thoughts openly, Rahul Chauhan invites others into the conversation. His closing question “What’s the No.1 thing you look for in a startup before investing?” underscores a belief in continuous learning and dialogue. Rahul Chauhan doesn’t present his checklist as the final word but as a starting point for thoughtful engagement. It is a call for investors and entrepreneurs alike to move beyond surface-level excitement and instead cultivate depth, rigor, and insight in their decisions.

Ultimately, Rahul Chauhan’s approach is less about shortcuts and more about frameworks that endure across market cycles. Whether you are an aspiring founder or a fellow investor, the principles he lays out serve as a practical compass. By focusing on fundamentals not just flash Rahul Chauhan demonstrates that clarity, consistency, and curiosity can be more powerful than mere excitement.