Rajesh Bansal stands at the crossroads of reflection and renewal, as he wraps up four transformative years as the founding CEO of the Reserve Bank Innovation Hub (RBIH). His journey is not just one of institutional building, but of reframing what is possible when vision meets relentless execution. In 2021, Rajesh Bansal stepped into a role that came with no predefined playbook no city, no office, and no team. All he was handed was a vision, sketched at 30,000 feet on a piece of paper. And yet, from that abstract outline, Rajesh Bansal went on to orchestrate a movement that has touched the lives of millions of Indians and has quietly redefined financial innovation under the umbrella of regulatory stewardship.

Rajesh Bansal didn’t simply occupy the CEO’s chair; he inhabited the role of a founder within a regulatory ecosystem that traditionally prizes caution over disruption. The call to “build a startup” was never explicitly made. Yet everything about the mandate told Rajesh Bansal to think like a pioneer. From one employee to a dynamic team of 90, from abstract intent to concrete, measurable, people-first impact the trajectory under Rajesh Bansal’s leadership has been one of quiet audacity.

At the heart of RBIH’s mission, championed by Rajesh Bansal, was an unwavering focus: frictionless finance for a billion Indians. This mission was never diluted, even as projects scaled and complexities multiplied. One of the standout achievements under Rajesh Bansal’s stewardship was the reimagination of credit for farmers. By immersing themselves in the realities of the Kisan Credit Card process, his team unearthed a cumbersome five-week, paperwork-laden journey. Under his guidance, that was transformed into a seamless five-minute digital experience. This innovation laid the foundation for the Unified Lending Interface (ULI), which now stands alongside UPI and the JAM trinity as pillars of India’s future-forward financial inclusion architecture.

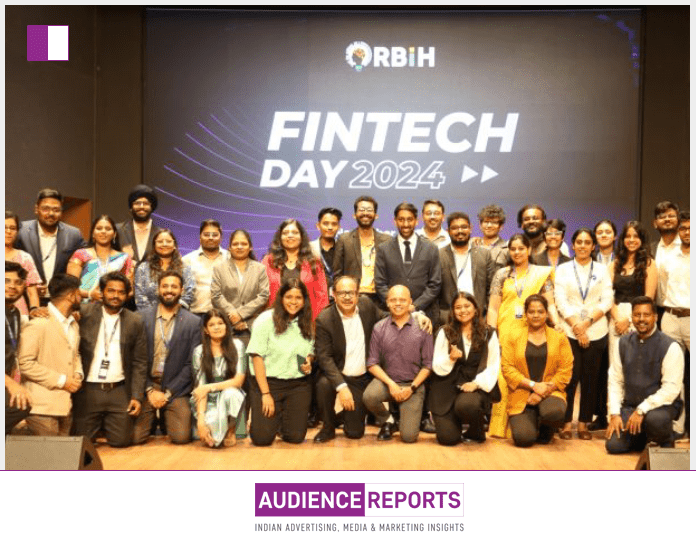

But Rajesh Bansal’s vision extended beyond just technology. He recognized that innovation meant democratizing opportunity. Through initiatives that empowered over 104 startups from a girl in Jodhpur to a taxi driver in Hyderabad Rajesh Bansal ensured that fintech entrepreneurship wasn’t confined to the metros or elite circles. Bank-fintech matchmaking, VC demo days, and rigorous mentoring became the new normal, offering a platform for diverse voices to shape India’s fintech landscape.

Another area where Rajesh Bansal’s leadership left a distinct mark was in gender-intentional finance. With the Swanari program, RBIH, under his watch, refused to let the sector ignore 50% of India’s population. From digital bookkeeping for Self-Help Groups (SHGs) to nano-loans tailored for women entrepreneurs, Rajesh Bansal embedded gender equity at the core of financial innovation, not as a side initiative but as an essential priority.

Equally significant was his push to reorient banks and financial institutions towards customer-centricity. Through DesignShaala and related programs, Rajesh Bansal championed solutions that focused on emerging cohorts Gen Z, gig workers, and digital natives ensuring that financial services were built with user needs at the center. His work contributed to a shift where “customer-first” evolved from a mere slogan to an industry-wide ethos.

Trust, too, was a domain where Rajesh Bansal directed transformative action. The creation of MuleHunter AI an advanced machine-learning model to flag suspicious financial activity wasn’t just about smarter fraud detection. As Rajesh Bansal emphasized, it was fundamentally about protecting the trust that anchors digital finance. By proactively addressing the problem of money mules, his team fortified the backbone of India’s digital economy.

Throughout his tenure, Rajesh Bansal navigated the delicate balance of being “the innovator under the regulator.” Perhaps one of his most understated yet profound contributions was making stakeholders believe that change meaningful, scalable, institutional change is possible even within large, legacy-driven organizations. Whether it was partnering with banks, engaging with VCs, collaborating with academia, or working alongside think tanks and governments, Rajesh Bansal fostered an ecosystem built on trust, experimentation, and shared purpose.

As Rajesh Bansal passes on the baton, his sense of fulfillment stems not from personal accolades but from having shaped an enduring institution. What began as a blank page under Rajesh Bansal’s leadership is now a meticulously drafted blueprint for innovation, one that will guide RBIH in its next chapter. His gratitude is extended to the RBI board, especially to Mr. Kris Gopalakrishnan, his partners across sectors, and most importantly, his team the mavericks who stood shoulder to shoulder with him in the foundational years.

Rajesh Bansal’s departure is not an exit from the mission but a transition to a different vantage point that of a committed cheerleader for RBIH and its continued journey. His story offers a nuanced lesson: meaningful innovation doesn’t always require starting from scratch in Silicon Valley-style startups. It can be nurtured within institutions, guided by purpose, and scaled with patience.

As India marches toward its vision of becoming a fintech nation, the contributions of Rajesh Bansal will quietly echo in the systems, platforms, and policies that empower everyday citizens. His tenure at RBIH stands as evidence that when intent meets execution, even the broadest visions drawn on paper can turn into blueprints that reshape a nation.

Rajesh Bansal leaves behind not just a legacy but a call to action to continue building, innovating, and believing in the possibility of inclusive finance. In his words and work, there’s an enduring reminder that leadership is less about titles and more about creating spaces where ideas can breathe and flourish.

Rajesh Bansal may have wrapped up his four years at RBIH, but the ripple effects of his leadership will travel far beyond.