In a world where financial literacy is often shrouded in complexity and obscurity, Akshat Modi emerges as a guiding light, illuminating the path towards a brighter financial future. As a Fellow Chartered Accountant (FCA) and a stalwart in personal finance and investment advisory, Akshat Modi’s mission transcends mere transactions; it embodies a profound commitment to empowering individuals with the wisdom and knowledge needed to navigate the intricacies of the financial landscape.

Akshat Modi’s Passion for Financial Literacy

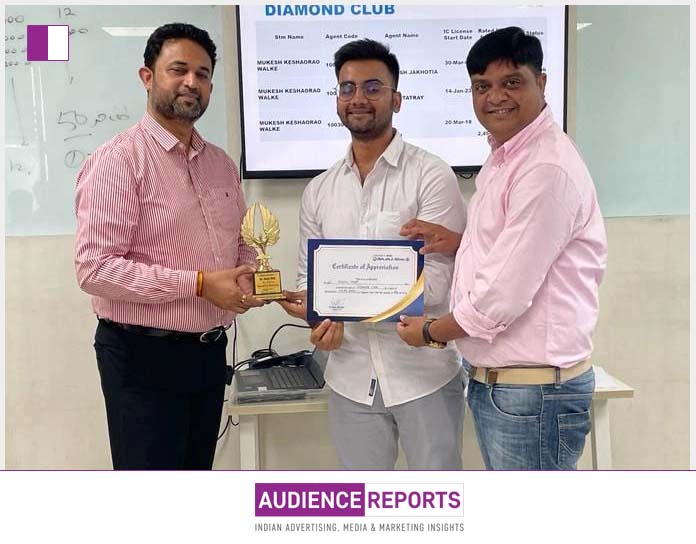

Driven by an unwavering passion for spreading financial literacy, Akshat Modi embodies the ethos of knowledge dissemination and empowerment. His recent engagement with young insurance consultants at Bajaj Allianz Life Insurance Corporation, Nagpur, epitomizes his dedication to fostering ethical practices and informed decision-making within the financial realm.

Insights Shared by Akshat Modi

During his address, Akshat Modi imparted invaluable insights on selling insurance ethically, emphasizing the importance of transparency, integrity, and client-centricity in every interaction. Here are some key takeaways from his enlightening speech:

Educating Clients about Investment Options: Akshat Modi stressed the significance of educating clients about various investment options available, empowering them to make informed choices aligned with their financial goals and aspirations.

Advocating for Realistic Expectations: By advocating for realistic expectations and discussing returns in percentage terms, Akshat Modi instills a sense of prudence and rationality, fostering a deeper understanding of investment dynamics among his audience.

Shedding Light on ULIPs and Their Taxation: With clarity and precision, Akshat Modi elucidated the intricacies of Unit Linked Insurance Plans (ULIPs) and their taxation, underscoring the potential benefits of tax-free maturity proceeds for annual investments below ₹2,50,000.

Highlighting Benefits of Traditional Insurance Policies: Akshat Modi highlighted the benefits of traditional insurance policies, emphasizing tax-free maturity proceeds for annual premiums under ₹5,00,000. Through his insights, he empowers individuals to navigate the diverse landscape of insurance products with confidence and clarity.

Engaging with the Audience: Recognizing the importance of active engagement and dialogue, Akshat Modi addressed queries and provided valuable insights, fostering an enriching exchange of ideas and perspectives.

Contributing to India’s Growth Story: Beyond his role as an advisor and educator, Akshat Modi is a visionary committed to nurturing participation in India’s growth story. Through advocacy for equity markets, Systematic Investment Plans (SIPs), and Systematic Investment in a Specific Objective (SISO), he champions a culture of informed investing and financial empowerment.

Joining Forces with Akshat Modi: As Akshat Modi extends an invitation to join him on this noble journey towards financial enlightenment, individuals are urged to embrace the opportunity to empower themselves with knowledge, wisdom, and foresight. By aligning with his vision and embracing the principles of ethical financial practices, individuals can embark on a transformative journey towards financial independence and security.

The Legacy of Akshat Modi: In every interaction, Akshat Modi’s name resounds as a beacon of wisdom, integrity, and empowerment. Through his unwavering commitment to spreading financial literacy and fostering ethical practices, he leaves an indelible mark on the hearts and minds of all those he encounters.

Embracing Financial Enlightenment: In a world where financial decisions shape futures and define destinies, Akshat Modi’s mission to spread financial literacy is not just a profession; it’s a calling. As individuals heed his call to action and embark on a journey of financial enlightenment, they unlock the keys to a brighter, more secure tomorrow.

In the tapestry of financial wisdom, Akshat Modi’s name stands as a testament to the transformative power of knowledge, integrity, and empowerment. Through his unwavering commitment to spreading financial literacy and fostering ethical practices, he paves the way for a future where individuals are empowered to navigate the complexities of the financial landscape with confidence and clarity. As we embrace his vision and join hands in this noble endeavor, we embark on a journey towards a brighter, more prosperous future for generations to come.